federal income tax definition

Federal Income Tax Withholding. Income taxes are taxes collected by federal state and local governments on the income of individuals and businesses.

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Means any Tax imposed by Subtitle A of the Code and any interest penalties additions to tax or additional amounts in respect of the foregoing.

. Medicare tax is a federal employment tax that funds a portion of the Medicare insurance program. A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings and. Marginal Tax Rate.

Federal income tax meaning. A tax on workers salaries or companies profits that is paid to the US government. Types Who Pays and Why.

For more information or to find an LITC near you visit Low Income Taxpayer Clinics or download IRS Publication 4134 Low. These taxes are typically applied to. By law businesses and individuals must file an.

In the case of any transfer of property subject to gift tax made before March 4 1981 for purposes of subtitle A of the Internal Revenue Code of 1986 formerly IRC. An income tax is a type of tax that is imposed on an individuals or businesss earned and unearned income. The federal government and most states have income taxes.

Federal income tax synonyms Federal income tax pronunciation Federal income tax translation English dictionary definition of Federal income tax. Income can come from a job investments a. The federal income tax system is a Progressive Tax System Progressive Tax System Progressive tax refers to the increase in the average rate of tax with the increase in the amount of taxable.

A tax levied on net personal or business. A list is available. LITC services are offered for free or a small fee.

Up to 16 cash back Federal income tax is collected through a withholding process where the employer deducts tax from the employee payroll. Federal income tax is a. A marginal tax rate is the amount of tax paid on an additional dollar of income.

For example the US. The rules and rates vary between individual states and the federal system. Gross income can be generally defined as all income from whatever source derived a more complete definition is found in.

Some terms are essential in understanding income tax law. The federal income tax is levied by the Internal Revenue Service on individual and corporate income to pay for government services. An income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction.

The marginal tax rate for an individual will increase as income rises. Imposes a federal income tax on its citizensboth. Income that is taxable must be reported on your return and is subject to tax.

Income that is nontaxable may have to be shown on your tax return but is not taxable.

What Is Federal Income Tax Liability Definition How It Works Business Yield

How Do State And Local Individual Income Taxes Work Tax Policy Center

United States Federal Budget Wikipedia

Common Tax Definitions H R Block

What Is Income Tax And How Are Different Types Calculated

Does Your State S Individual Tax Code Conform With The Federal Code

How Do Federal Income Tax Rates Work Tax Policy Center

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

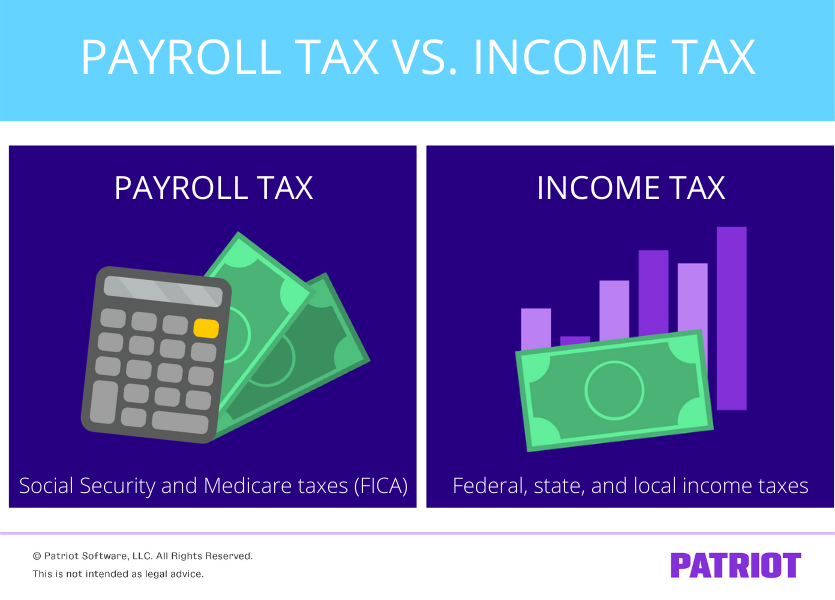

How Are Payroll Taxes Different From Personal Income Taxes

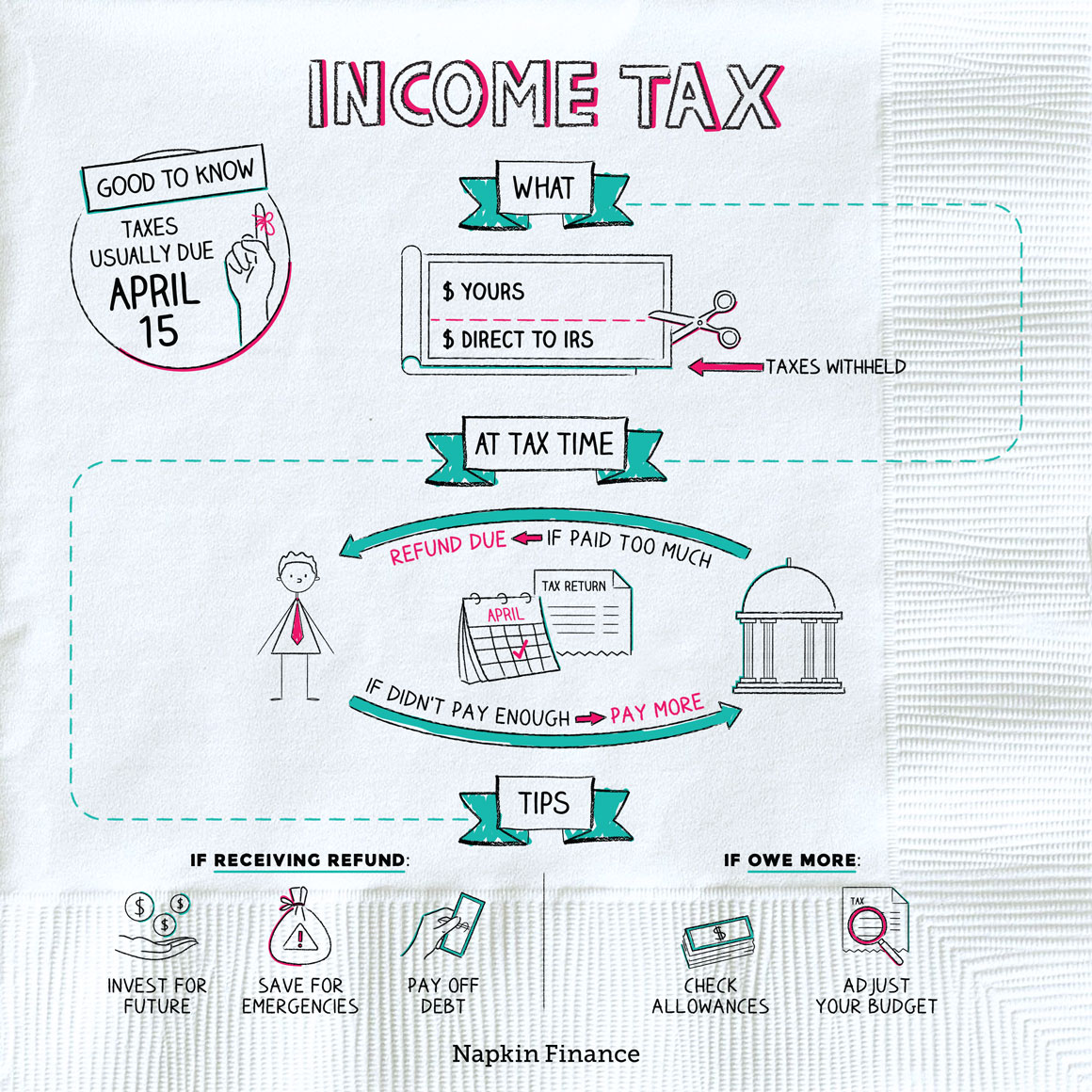

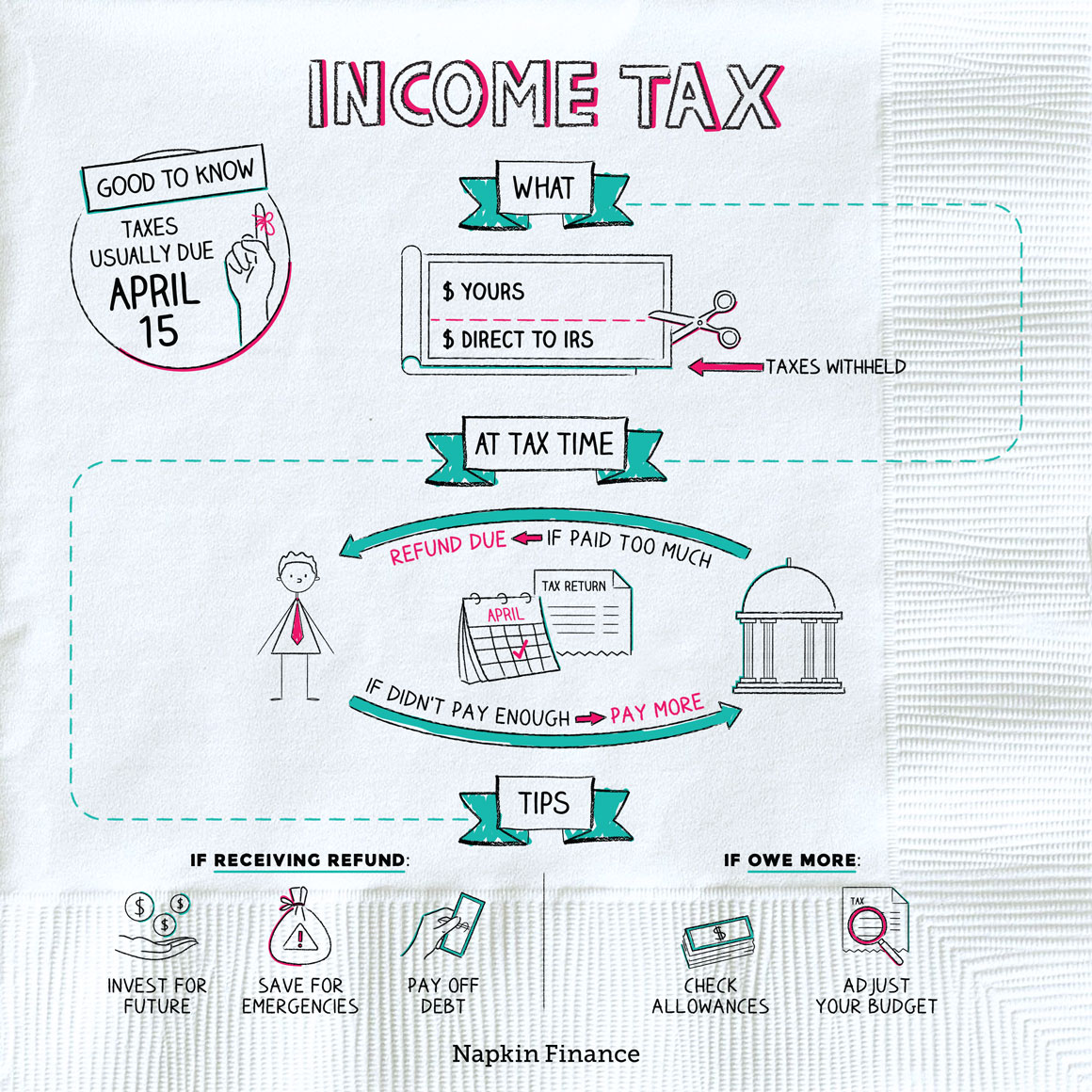

What Are Income Taxes Napkin Finance

Paycheck Taxes Federal State Local Withholding H R Block

Taxes Congressional Budget Office

Corporate Income Tax Definition Taxedu Tax Foundation

:max_bytes(150000):strip_icc()/Tax_Bracket_Final-ca47afa9764b4cc4bc0b3d2237e972cb.png)

Understanding Tax Brackets With Examples And Their Pros And Cons

Taxation In The United States Wikipedia

Provision For Income Tax Definition Formula Calculation Examples

Income Tax Definition Individual Income Tax Taxedu

Income Tax Definition What Are Income Taxes How Do They Work

/tax_refund-7f8e7a5064a0411381a554001e842085.jpg)